If you’ve ever wondered, ‘How much do letting agents charge?’, you’re not alone. Navigating the terrain of letting agent fees is crucial for any UK landlord aiming to maximise their income—and costs can vary widely depending on the services you need. This guide dives into what these fees entail, how they are structured, and their implications for landlords and tenants.

Instant Rental Price Estimator

Discover your property’s true rental value in seconds with our free, UK-wide price comparison tool.

- Letting Agent Fees for Landlords

- Compare Letting Agent Fees

- Typical Letting Agent Fees?

- Understanding Additional Fees

- Are Letting Agent Fees Tax Deductible

- How Much Do Letting Agents Charge?

- Choosing the Right Partner Agent

- Online vs. Traditional Letting Agents

- Tips for Reducing Letting Agent Fees

- Maximise Your Rental Income

Letting Agent Fees for Landlords

Letting agent fees (also referred to as property management fees when covering ongoing services) are charges levied by agents to landlords (and occasionally tenants) for services related to renting properties.

These fees vary significantly depending on the type of service provided:

Let-Only Service:

This basic service involves the agent finding tenants for your property. Generally, the cost is a percentage of the first month’s rent, typically between 50% and 80%. So a monthly rent of £1000 would typically incur a fee of between £500 – £800 inc vat.

Rent Collection Service:

This service is ideal if you prefer to avoid managing monthly rent collection. In addition to the let-only service, the agent collects rent and manages arrears. They usually charge around 8% to 12% of the monthly rent.

Full Property Management:

This service includes all-inclusive property management fees, covering tenant sourcing, rent collection, maintenance, and legal compliance. Typically, fees range from 12% to 15% of the monthly rent (up to 20% in London).

Instantly Compare Letting Agent Fees

Navigating letting agent fees can feel overwhelming. How do you know you’re getting the best deal for your property?

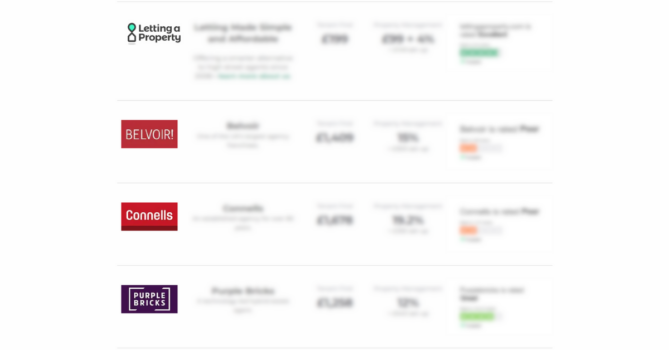

We’ve compiled a list of the most popular letting agents and their fees, updated quarterly. The last update was in January 2025.

Landlords typically save an impressive £1,966 annually using our simple letting agent fees comparison tool.

Whether you’re considering let-only, rent collection, or full property management, we’ll help you make an informed decision—and save money along the way!

Here’s a sneak preview…

What Are Typical Letting Agent Fees?

Letting agent fees for landlords can range from a simple percentage of the monthly rent for essential services to more complex fee structures. They may include additional charges for maintenance management, tenant screening, and handling legal paperwork.

The specific costs can vary widely depending on the agency and their services.

Understanding Additional Fees Charged by Letting Agents

Besides the standard letting, rent collection, and property management fees, landlords should also be aware of other potential charges that letting agents might impose.

These can include setup fees at the beginning of a new tenancy, inventory fees, renewal fees if a tenant decides to extend their lease, and exit fees when terminating the agency agreement.

Additionally, some agents may charge for conducting regular property inspections, handling legal disputes, and preparing annual financial statements for tax purposes.

Landlords should thoroughly review the agency’s fee schedule (which must be available on their website) and contract terms to ensure transparency and avoid unexpected costs. Discussing these fees upfront and negotiating terms can also help maintain a cost-effective relationship with your letting agent.

Are Letting Agent Fees Tax Deductible?

For landlords, it is essential to recognise that letting agent fees are considered a deductible expense against their rental income on tax returns. This classification makes these fees a cost of doing business and a tax-efficient way to manage property investments.

How Much Do Letting Agents Charge for Landlords and Tenants?

For landlords, fees generally range from 8% to 20% of the monthly rent, depending on the level of service required. Some agencies also impose setup fees or a fixed fee per tenancy agreement.

Following the introduction of the Tenant Fees Act 2019, the permissible charges to tenants have been significantly reduced, mostly limiting them to deposits, rent, and charges for contract breaches.

Choosing the Right Partner Agent for Your Needs

Opting for a local or national agent can impact both the level of service and the cost. Local agents often provide a more personalised service and possess deep knowledge of the local market, which can benefit property viewings and tenant interactions. On the other hand, national agents might offer a broader reach and potentially lower upfront costs.

Online vs. Traditional Letting Agents

Furthermore, online agents usually offer lower fees due to reduced overheads, making them an attractive option for landlords who are comfortable managing some responsibilities. Conversely, traditional agents provide significant value through comprehensive property management services that might justify the additional cost, especially for landlords who prefer a hands-off approach.

Tips for Reducing Letting Agent Fees

While some landlords attempt to cut costs by opting for let-only services or taking on property management tasks themselves, there’s a better way to save without compromising on quality or convenience.

At LettingaProperty, we offer competitive pricing on full-service property management that ensures landlords avoid hidden costs while enjoying expert support.

- Transparent pricing with no unexpected fees.

- Savings of up to £1,966 annually compared to high-street agents.

- A streamlined approach to tenant sourcing, rent collection, and property management—all under one roof.

Ready to Maximise Your Rental Income?

Understanding letting agent fees is just the beginning of optimising your property’s profitability. The next step is knowing exactly how much rent you can earn.

With just a few clicks, you can uncover your property’s earning potential and make informed choices to maximise your returns. Get Your Free Valuation Now!

Why Choose LettingaProperty?

As a landlord, you deserve a letting agent that works smarter, not harder, to boost your property’s performance. At LettingaProperty, we stand out by offering:

- Hassle-Free Lettings: From tenant onboarding to ongoing management, we take care of everything.

- Cost-Effective Services: Avoid hefty high-street fees and hidden charges.

- Expert Support You Can Trust: Helping landlords since 2008, with consistently high ratings on TrustPilot and Google.

- A Smarter Online Platform: Manage your property with ease, anytime, anywhere.

Choose us for a reliable, cost-efficient, and innovative approach to property management. Ready to experience the smarter way to let your property?

Want to learn more about how we can help? Book a callback today and let’s discuss how we can transform your letting experience!

—

Frequently Asked Questions

What Services Are Typically Included in Full Property Management?

Full management services generally encompass tenant screening, rent collection, maintenance coordination, handling tenant communications, and managing legal and compliance issues, thus easing landlords’ administrative burden.

How Can Landlords Verify a Letting Agent’s Membership with Industry Associations?

Landlords should request proof of membership directly from the agent or verify through the websites of associations like ARLA, UKALA or NAEA, which usually list active members.

Fees Associated with Lease Renewals and Long-term Tenancies.

Some agents charge for renewing leases or managing long-term tenancies, and these fees should be clarified in the agent’s terms of service.

What Is the Standard Rate for Let-Only Services Charged by Letting Agents?

The rate for let-only services typically ranges from 50% to 80% of the first month’s rent, covering advertising costs, tenant screening, and securing a tenancy agreement.

How Do Fee Structures Vary Between National and Local Letting Agents?

National agents might offer lower fees due to their larger scale operations, whereas local agents may charge slightly more but offer more personalised service and local market expertise.

Impact of the Tenant Fees Act 2019 on Landlord Charges to Tenants

The Tenant Fees Act 2019 restricts the fees landlords can charge tenants, including caps on deposits and banning most other fees. Ensuring compliance is crucial for landlords.

Effective Strategies for Negotiating Lower Fees with Letting Agents

Landlords can negotiate lower fees by offering multiple properties for management or proposing longer-term contracts to leverage negotiations.

Common Complaints About Letting Agents and How to Avoid These Issues

Common complaints involve poor communication and unexpected fees. Choosing agents with transparent fee structures and good TrustPilot reviews and establishing clear communication protocols can help avoid these issues.